Now is a good time for Americans to consider investing in Cape Verde, officials in the West African archipelago say.

They spell out the reasons why in interviews with Africa Strictly Business: Strategic location; an economy is on the upswing, with growth expectations at 3 percent or more for 2015 and 2016, up from 2 percent in 2014; Europe, its traditional source of most investment, tourism and remittances from expatriate Cape Verdeans, is too weak to support the country as in the past; high praise for political stability and good governance; a beneficiary of the Africa Growth Opportunity Act (AGOA), with duty-free entry to the United States for its exports.

“Cape Verde is a safe country. It’s good governance, coupled with economic and political stability, has provided the country with great investment opportunities,” says Luisa F. Tavares, spokesperson for Cape Verde Investments (CVI), the official agency charged with promoting Cape Verde as a competitive business and service center.

The country has a lot more going for it, Tavares adds, “like strategic geographic location, access to [mainland Africa] markets, a rich cultural with a diverse population, attractive investment incentives and human resources.”

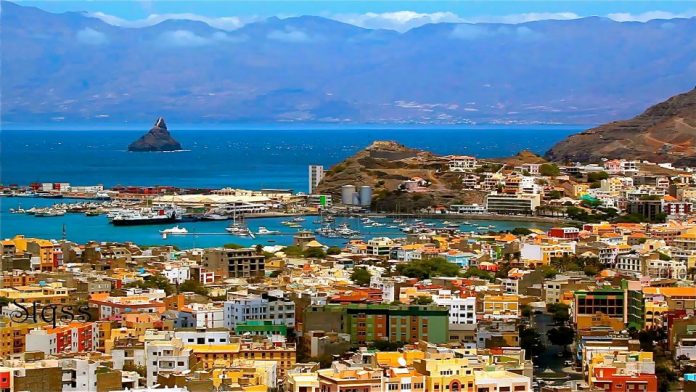

Americans should not be deterred by the country’s small market—population just below 500,000—spread out over nine islands, CVI says. A group of 10 islands about 370 miles off the coast of West Africa in the Atlantic Ocean and just slightly bigger than the state of Rhode Island, Cape Verde in 2008 was upgraded from a “Least Developed Country” to a “Lower Middle Income Country,” by the United Nations. It was the first country to successfully conclude a Millennium Challenge Corporation compact (worth $110 million), and in 2012 became the first country ever to sign a second compact (worth $66.2 million) after consistently displaying good economic and political governance.

Other reasons officials like to tout for Americans include: great weather year round; a topography that ranges from tropical beaches to mountains; relatively short flight time from the U.S. east coast to Cape Verde (just under seven hours); enormous tourism growth potential; two international airports; few regulatory barriers to investment; a 5-year initial tax holiday for investors and developers and a subsequent tax reduction by 50 percent on corporate tax for the following 10 years to non-resident investors; in some cases, depending on the size of the investment and level of local employment generated, an exemption on import duties for building materials for construction and private investors; and very competitive property prices.

“Cape Verde pursues indeed a liberal investment policy and actively encourages foreign direct investment in all sectors of the economy. Attractive packages of both fiscal and non-fiscal incentives, tailor made to the needs of each priority area of investment, are offered to investors,” says Elisabeth Gonçalves, investment coordinator for Cape Verde Investments. “Since 2000, Cape Verde’s exports qualify for free entry into the US market, under the AGOA, even though the country has not been able to take good advantage of that facility.”

Constrained by a lack of natural resources, a huge trade deficit, and the size and fragmentation of the territory, Cape Verde on its own does generate enough capital to finance its economic development, Gonçalves concedes. “Foreign capital is a strategic resource in Cape Verde development, a key instrument to bridge some of the gaps in the economy. This prompted the Cape Verdean government to create several mechanisms to attract foreign direct investment,” she says.

Gonçalves favors a major push to interest American business, despite complaints by some locals that Cape Verde already is allowing too much foreign investment.

“Although Cape Verde has a very attractive business environment for all foreign investment, it has always been European investors to choose Cape Verde as an investment destination. This makes us rethink how to build a strategy to make Cape Verde seen by American investors as an investment destination,” she says.

She cites as an example the 2014 revised and approved direct foreign investment law, which provides customs and fiscal incentives schemes that make it easy to set up a business in the country. The one-stop business concept is already working under Cape Verde Investments, whereby foreign investors can have their investment proposals assessed and decided on in 75 days maximum, she notes.

Tourism is a particularly bright investment sector for Americans, the CVI officials contend, citing a recent African Development Bank report that shows tourism-related foreign investment and construction as engines of growth for the Cape Verde economy.

“Tourism and leisure has been the backbone of the Cape Verdean economy for the past two decades. This sector remains a major constituent of our economy and FDI is very much welcomed in resorts and luxury tourism, resorts for second buyers, health tourism (retirement homes), thalassotherapy (the medical use of seawater as a form of therapy); sports tourism; and ecotourism,” Tavares says.

For their part, U.S. officials are encouraging investment in the energy sector. The government of Cape Verde government is investing heavily in alternative energy resources. The country exceeded its goal to produce 25 percent of electricity from renewable sources by the end of 2011 and is now working toward 50 percent by 2020.

According to the Cape Verde Investment Climate Report published by the U.S. Embassy in Praia, Cape Verde’s capital, “Cape Verde’s ambitious growth plans will require big investments in power and water infrastructure, and their use of alternative energy presents great opportunities for American companies.”

Tavares agrees. “Cape Verde has one of the best wind regimes in the world and a great potential for solar energy. The government is currently favoring the development of a competitive renewable energy cluster and promoting investments in renewable energy parks in most of the main islands,” she says.

Potential investors who may be reluctant to take on a country as small as Cape Verde, with a market of just about 500,000 people spread over multiple islands, should consider the country’s location at the crossroads of Atlantic air and maritime routes that connect South America and Europe, as well as North America and Africa, Gonçalves says.

“The country’s strategic geographical location places it as a gateway to the 300 million-plus consumers with growing per capita incomes in West Africa, as a member of the regional economic community with free movement of goods and services. Out of the six countries that are growing the most in the continent over the past five years, four—Nigeria, Ghana, Sierra Leone, and Liberia—are located in this region,” she asserts.

She advises U.S. businesses to use Cape Verde not only to penetrate the West African market, but also to reach the Cape Verde diaspora in the U.S. New England region, where an estimated 600,000-plus Cape Verdeans reside mainly in Massachusetts, Rhode Island and Connecticut and are eager to consume goods from the homeland.