Single-Entry Visa

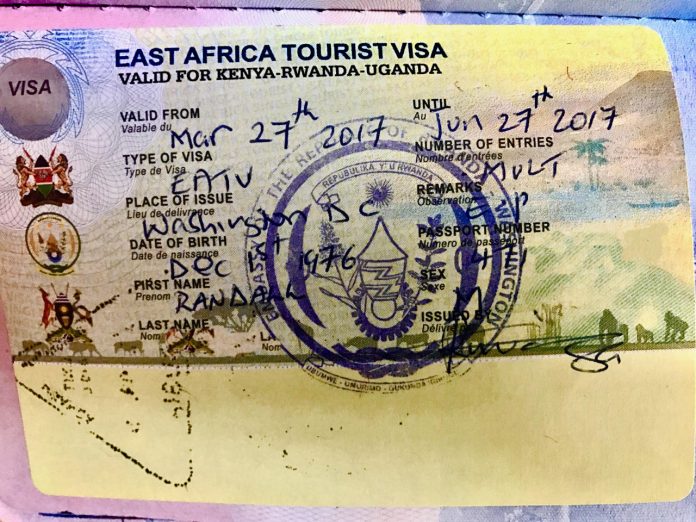

Rwanda, Uganda and Kenya failed to implement the three-country single tourist visa on January 1, as was promised at the 2013 World Travel Market in London. Instead, the single tourist visa system, which will enable tourists to move freely between these countries with only a single visa, will be launched officially later this year. The joint visa will be valid for 90 days and will cost US$100. It will be available from any member country’s entry point, diplomatic or immigration office, or online. Beyond facilitating tourism, the single entry visa is in line with the East African Community’s (EAC) efforts to create a customs union that would liberalize trade among the partner states. The EAC is also committed to the establishment of the East African Monetary Union, which foresees the adoption of a single currency in ten years. If Tanzania and Burundi eventually decide to join the three other EAC member states, the region will have a joint market of 130 million people.

Diaspora Talent

The Africa America Institute is creating a feature on its website to connect African talent with Africa-focused jobs in the U.S. and in Africa. The feature, called “Talent Central,” is intended to address the human resource needs of institutions and companies operating in the U.S and on the continent through a jobs board, and career and repatriation tips, tools and blogs targeting the African Diaspora. It is scheduled to roll out in February at aaionline.org. Blogs and guest posts will address relevant issues, such as what recruiters look for in candidates, making a smooth transition to working in Africa, career planning tips, and insight into the latest job trends and developments on the continent. “Talent Central” will be a “go-to” resource for potential employers and academia looking for well-educated African talent, particularly from the Diaspora in the U.S.

SME Finance

Business Partners International launched BPI East Africa LLC, a US$30 million investment company for family owned small and medium enterprises in East Africa. BPI committed $6 million to the new entity, which will initially focus on Kenya, Rwanda and Uganda, with the potential to expand into other countries in the region. BPI East Africa will encourage entrepreneurship, facilitate job creation and contribute to small enterprise development by providing access to risk capital funding and technical assistance and mentorship support to SMEs in East Africa. SMEs will play a critical role in the economic growth that is expected on the African continent. BPI East Africa will consolidate BPI’s experience into an attractive investment opportunity for both Business Partners and other like-minded investors, to gain portfolio exposure in an underserved segment of the business in East Africa while contributing to the region’s development. Despite the many challenges that African entrepreneurs face, they often manage to overcome these and succeed in various industries, which contributes positively to the economy of their respective countries.

Wealth Statistics

South Africans are the wealthiest individuals in Africa with US$11,310 in wealth per person, well below the global average of $27,600, according to New World Wealth’s January 2014 report on African wealth statistics. Ethiopians are the poorest with $260 per person. Rounding out the top, in order of rank, are Libya ($11,040 per capita), Namibia ($10,500), Tunisia ($8,400) and Botswana ($6,580). In earlier research, New World Wealth said millionaires in Nigeria, Kenya and Angola will more than double by 2030, boosting the prospects for private banking in Africa. Millionaires in Nigeria, Africa’s biggest oil producer, will rise 174 percent to 43,000 from 15,700 in 2013, the U.K.-based company said, based on a sample of high-net-worth individuals and World Bank data. The continent’s richest man, Aliko Dangote, hails from Nigeria and is reported to be worth more than $22 billion. South Africa will retain the highest number on the continent with a 78 percent increase to 86,700. The number of Africans with at least $1m of investable assets climbed 9.9 percent to 140,000 in 2012, according to a report published in June by Cap Gemini and Royal Bank of Canada.

Luxury Goods

Africa is set to become a key battleground for the luxury goods industry. Between 2008 and 2013 sales of luxury goods in Africa grew by almost 35 percent in current value terms and is forecast to increase by a further 33 percent in the next five years, according to Euromonitor International. U.S.-based Bain’s worldwide market study said total luxury goods revenue on the continent would reach €2bn in 2013, up from €1.5bn in 2011. Companies such as Cartier, Louis Vuitton, Burberry, Gucci, Fendi and Salvatore Ferragamo have stores in Africa. In addition to upmarket watches, clothing and handbags, wealthy Africans spend lavishly on alcohol and fast cars. Nigeria was the third-fastest growing market in the world for champagne between 2007 and 2012 and its market is forecast to increase by a further 78 percent in the five years. Total consumption reached 750 million bottles in 2012, higher than in Canada and the UAE, and placed Nigeria among the top 20 champagne markets in the world. Its cognac market is now bigger than Canada’s. South Africa, home to 60 percent of Africa’s millionaires, has the continent’s most developed luxury retail sector.

Ports

CMA CGM Terminals, the port-operating arm of French ocean carrier CMA CGM, is acquiring a 25 percent stake in Nigeria’s Lekki container terminal from International Container Terminal Services Inc. of the Philippines. CMA CGM Terminals signed a sub-concession for the terminal in 2012. The terminal, situated around 38 miles east of Lagos, Nigeria’s commercial capital, is expected to be fully operational in 2017. The Lekki facility will have 1,200 meters of straight-line quay, 16 post-Panamax cranes, a 66-hectare yard area and an initial annual capacity of 2.5 million 20-foot-equivalent units. CMA CGM said the terminal, which is designed to enable an increase in capacity, will provide a solution to the current congestion in the local Nigerian market and serve as a regional hub for West Africa.

Rails

Kenya launched construction of a Chinese-funded $13.8 billion flagship railway project, hoping to dramatically increase trade and boost Kenya’s position as a regional economic powerhouse. A key transport link replacing dilapidated British colonial-era lines, the railway will run from the busy port city of Mombasa inland to the highland capital Nairobi. It could eventually extend to Uganda, and then connect with proposed lines to Rwanda and South Sudan. China has funded the project only for the first 280-mile (450-kilometer) section from Mombasa to Nairobi, a cost of $5.2 billion. Work on that section is being done by the state-owned China Road and Bridge Corporation (CRBC), and is expected to be completed by 2017. Kenya, and East Africa in general, currently rely almost exclusively on road transport. The project is considered the region’s largest infrastructure project for a century.

Logistics

The Suez Canal Authority has invited 14 consortia to present plans to develop the waterway into a logistics and industrial hub. The successful bidder will be selected within three months and will have a further six months to present a master plan. This will be followed by a conference of international investors in November. Work on the project could begin as early as 2015, according to the Egyptian government. Egypt wants to turn 29,344 square miles (76,000 square kilometers) around the canal into an international industrial and logistics hub, reviving economic development after more than three years of economic and political turmoil. The Suez Canal is the fastest shipping route between Europe and Asia and has been steadily luring Asia-to-east coast of North America traffic from the Panama Canal. Generating annual revenues of around $5 billion, it has become an increasingly important economic lifeline for Egypt as tourism has collapsed following a popular uprising in 2011. The Egyptian military recently stepped up security along the canal.