In Africa, building innovation ecosystems has become an imperative for governments and business communities. And, in a few places, such ecosystems are beginning to take shape.

Nairobi, Kenya, has gained a reputation as the startup capital of Africa. A half dozen small innovation hubs and incubators have been launched in the past three years, and the city seems to be crawling with entrepreneurs. The first and foremost of the tech hubs, iHub, provides a model for other organizations around Africa that want to plant the seeds for innovation and entrepreneurship.

You can think of iHub as an attempt at creating an innovation ecosystem in a box. The facility, occupying four floors in a building in downtown Nairobi, is run by the local startup community rather than the government or a corporation, though it has backing from nonprofits and tech companies. iHub’s programs include startup meetings and contests, interactions with venture capitalists, a business incubation space, a supercomputer provided by Google and Intel, and a coffee bar where people meet informally. The iHub organizers look for gaps in the local business ecosystem and try to fill them. An example is iHub Research, which facilitates scientific research collaborations.

An essential element of iHub’s initial success is that it’s “open and community focused,” says one of the co-founders, Erik Hersman. Because of that, he says, the organization responds to the needs of entrepreneurs rather than seeking to satisfy external agendas.

Already, several promising young companies have emerged from the iHub milieu. They include Kopo Kopo, a mobile purchasing management service for small and medium-size businesses, and M-Farm, a mobile service that connects farmers with buyers of their crops and produce.

Key to the burst of entrepreneurship activity in Kenya is the success of M-PESA, the amazingly popular mobile money service offered there by mobile telecommunications carrier Safaricom. The M-PESA service was originally launched in Kenya but has now spread to other African countries. Everywhere it goes, it serves as a technology platform that tech startups build added services on top of and that other mobile carriers imitate. As a result, mobile money is becoming the driving force behind a lot of technological innovation and startup activity in Africa. It provides a means for African tech companies to leapfrog their counterparts in more developed economies and offer African businesses and consumers vital services in brand new ways.

Inspired by the success of M-PESA and iHub, a handful of universities in Kenya have begun developing programs aimed at preparing students for careers as entrepreneurs and at incubating startup companies. The leader among them is Strathmore University, a top private university with respected programs in business and information technology.

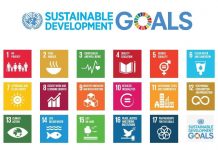

In 2011, Strathmore established @iLabAfrica, which is dedicated to fostering research, innovation and entrepreneurship with the goal of helping Kenya to achieve the United Nations Millennium Development Goals. The organization conducts collaborative research, identifies technologies that can address social problems and helps students launch companies. Right now, seven companies are being incubated there. Among them is Buymore, which provides consumer loyalty programs for university students. “We have students with very bright ideas. If they are supported they can move to the next stage and go commercial,” says Joseph Sevilla, a Strathmore professor who is director of @iLabAfrica.

The government of Kenya has also played an important role in supporting the country’s innovation ecosystem over the past few years. The government has improved broadband connectivity by bringing undersea fiber-optic cables into the country, which was one of the preconditions that gave rise to a massive IT industry in India. Next it launched Kenya’s Open Data Initiative, where government data is made readily available via a web portal to government agencies, businesses and citizens alike. It’s the first initiative of its type in Africa, and observers believe this kind of transparency will strengthen democracy as well as boost economic activity. In early 2013, the country launched the National ICT Master Plan, a strategy aimed at helping Kenya become a knowledge economy in the next five years.

A key player in these initiatives is Bitange Ndemo, the permanent secretary in the Ministry of Information and Communications, who left academia to take the ministry job in 2005. His dream now is to develop a mini-Silicon Valley a short distance from Nairobi, called Konza Techno City, which will focus on software development, data centers and business process outsourcing. “We need this ecosystem so we can begin to build the future entrepreneurs. We can create the opportunity for a Bill Gates to emerge in Kenya,” Ndemo says.

Thanks to these initiatives by government, academia and the startup community, Kenya is emerging as a model for other African nations. They look to Kenya for ideas and success stories that will bolster their own efforts. Already, more than 30 tech hubs and incubators have popped up across the continent, including Hive Colab in Uganda and ActivSpaces in Cameroon. Something is happening here. Sparks are flying that could ignite economic dynamism not just in Kenya, but across all of Africa.

As encouraging as Africa’s budding startup clusters are, business and government leaders are quick to point out that this is just the start. A host of daunting challenges must be overcome before healthy, large-scale innovation ecosystems will be able to flourish.

There are three critical shortages: skills, venture capital and a culture that encourages entrepreneurship. In each case, promising experiments are being tried that, over the longer term, could turn the tide. They provide models that others can copy or learn from.

Skills

While there are many colleges and universities in sub-Saharan Africa, too often they are overcrowded, the academic programs aren’t up to date and fundamental scientific research suffers from a shortage of funding. Perhaps most critically for the purposes of innovation ecosystems, the focus of most of these institutions is on preparing students to take jobs in already-existing companies, rather than giving them the skills and experiences that would enable them to start their own businesses.

For Joel Macharia, the founder of PesaTalk, a financial news and data website in Kenya, inexperience contributed to business problems and a break with his financial backers that caused him to quit in early 2013. He had learned to be a CEO by reading books. Other startup entrepreneurs he sees around him know even less about business fundamentals.

Typically, he says, a handful of guys who know how to code mobile apps will get together and decide to start a company. When it comes to managing and building a business, they have little relevant education and experience. “These people need practical training in what a company is and how business works,” he says.

Education and business leaders recognize this knowledge gap, and they’re doing something about it. In some cases, they try to fill the gap on the fly — while they’re busy doing something else.

Eghosa Omoigui, managing general partner of venture capital firm Echo VC Partners, with offices in Silicon Valley and Nigeria, helps the leaders of African companies his firm invests in by pairing them up with mentors at US-based companies. Once a week, pairs of CEOs get on Skype together and talk over business problems. The firm has also run basic training sessions for startup entrepreneurs in Lagos, Nigeria.

This kind of make-do activity is necessary but not sufficient. Africa needs institutions that are designed from the ground up to prepare young people to be leaders and entrepreneurs. It has a compelling model in the African Leadership Academy, a five-year-old school based in Johannesburg, South Africa. The organization identifies young people between the ages of 15 and 19 who demonstrate leadership potential, a passion for Africa, an entrepreneurial spirit and a track record of community service. They are invited to enter a two-year pre-university program comprised of courses in leadership, entrepreneurship and Africa studies. They launch businesses even while they study. “If you give them practice at that age, they will have the confidence and experience to do much bigger things later,” says Fred Swaniker, the Ghanaian serial entrepreneur who founded the Academy.

Most of the graduates attend top universities in the United States and Europe. The Academy forgives the debts of those to return to Africa by age 25 and stay for at least 10 years. The idea is that they will remain part of the Academy network for the rest of their careers.

Because of the Academy’s financial approach, where most students get room and board for free, it can’t scale to a mass level. But some elements of the program could be adopted by other schools — including the curriculum, the practical experiences in entrepreneurship, and the social networking angle. The government of Nigeria, for one, is developing training programs with universities and industrial partners that provide technology and entrepreneurship skills. “Our graduates need to be job creators, not job takers,” says Ngozi Okonjo-Iweala, Nigeria’s minister of finance.

Capital

In sub-Saharan Africa today, a lot of people talk about venture capital, but not many do much about it. The levels of private equity investment have been trending up, from 3 percent of all emerging market funding in 2007 to 6 percent in 2010, according to Ernst & Young. But most of the investments are in mature companies; only a tiny fraction of them are seed or first-round investments. The problem is that there are only a handful of true venture funds based in Africa and most U.S. and European VCs don’t have the local knowledge and connections, or the right business models, to make a real go of it in Africa.

One stumbling block is that venture capitalists typically want to make investments of between US$250,000 and $1 million. An East African tech startup with 10 employees can run on $50,000 for a year. What’s needed is a combination of wealthy African businesspeople who are willing to invest small amounts in early-stage startups and patient, locally-based venture capitalists who know how to help companies in Africa succeed.

Venture capitalist Omoigui of Echo VC Partners plans on launching a program in Nigeria for teaching businesspeople how to invest in startups — becoming so-called angel investors. That should happen in every tech hub across the continent. And, ultimately, somebody needs to pool angel capital into funds so individual investors can share risks and rewards.

Meanwhile, Hasso Plattner Venture Partners Africa provides the model for how venture investing should be done in Africa. The firm, which was established in Cape Town, South Africa, in 2005 by SAP AG co-founder Hasso Plattner, has made 11 investments so far, all of them in South Africa. Now the firm plans on expanding to Nigeria and Kenya.

The directors at HPVP Africa are acutely aware of the need to establish healthy innovation ecosystems to serve as Petri dishes for startups. They help out by staging conferences that bring together business thought leaders with entrepreneurs. They also co-sponsored IBM SmartCamp in South Africa. “We have tens of millions to invest but not many investment opportunities,” says Marc Balkin, a partner at HPVP Africa. “We want to do things that will improve the climate for entrepreneurship.”

Culture

One of the most important changes that could improve the climate for entrepreneurship is cultural. In South Africa during apartheid days, Black Africans were discouraged from owning businesses. As a result, there’s no established tradition of entrepreneurship and there are few role models for young Africans. In addition, across the continent, families who scrape together funds to put their children through university want them to get secure jobs with steady paychecks when they graduate. They put incredible pressure on their children to join corporations.

One last thing: in Silicon Valley, failure by entrepreneurs is tolerated — even celebrated. People learn by taking risks and making mistakes. In Africa, failure in business is shameful. That puts a real damper on the startup economy.

How to you change culture? African business leaders hope that after today’s crop of entrepreneurs builds successful companies, the startup path will be more respected by African families and more compelling to youngsters. If that happens, there will be more entrepreneurs, more success stories and more people willing to take risks. It’s a self-reinforcing cycle.

Already, there are a handful of examples of African startup entrepreneurs who have made good in a high-profile way. South African Mark Shuttleworth, for instance, sold his Internet security startup, Thawte, for $575 million, which he used in part to become one of the first space tourists, traveling aboard the Russian Soyuz TM-34 million to the International Space Station in 2002. But success stories like Shuttleworth’s are still rare.

South African businessman Ezra Ndwandwe isn’t waiting for conditions to improve. He’s the producer of The Big Break Legacy, a reality TV show aimed at identifying, educating, inspiring and empowering entrepreneurs. In the weekly series, contestants complete in real-life startup challenges to win a 5 million Rand (USD500,000) investment prize. In the first season, in 2012, the show attracted over one million viewers per episode, and was ultimately rebroadcast on CNBC in 48 other African countries.

“This is about changing culture — showcasing entrepreneurship as an alternative career,” says Ndwandwe. “We have to change the national dialogue from one about government creating jobs to focus on businesses and government working together to create businesses that will give us the jobs we’re looking for.”

The above is excerpted from IBM’s “Point of View Essay issued by the company’s Communications Department in May 2013.