A new analysis confirms what has long frustrated East Africa’s business leaders: progress toward the establishment of a common market across Burundi, Kenya, Rwanda, Tanzania and Uganda is too slow, with some of these very states introducing new restrictions even after the common market protocol entered into force in 2010.

Laws, regulations, discriminatory practices, excessive leniency in granting exemptions from protocol obligations, and government foot-dragging are undermining the achievement of the common market, the analysis concludes.

The East African Common Market Scorecard 2014: Tracking EAC Compliance in the Movement of Capital, Services and Goods tracked how far the five countries had reached by 2013 in fulfilling their commitments to freeing up trade in capital, services and goods as provided in the EAC Common Market Protocol. Published jointly in February by The World Bank and the East African Community Secretariat it is based on a review of 683 laws and regulations relevant to the common market, along with key legal notices, reports and trade statistics.

The slow pace of the march to an EAC Common Market is vexing even to some government officials. Just yesterday, Phyllis Kandie, cabinet secretary in Kenya’s Ministry of East African Affairs, Commerce and Tourism, appealed to member governments to fast-track the reduction of non-tariff barriers.

“As a region we have been tackling trade hurdles to reduce cost of doing business. However, each time we embark on confronting the identified impediments others emerge. This has continued to frustrate growth in the region and investments,” she is quoted as saying in Nairobi, Kenya, on March 31, during a media sensitization workshop on EAC integration.

According to the scorecard, $22.7 billion in intra-regional trade was lost to other regional trading blocs between 2005 and 2012 because member sates ignored most of the measures agreed upon under the common market protocol. The high cost of doing business associated with this inaction has so frustrated business leaders that at least one of them is threatening court action against regional governments.

“Because the bureaucrats are not willing to tackle the trade obstacles, as the business community we are contemplating seeking legal redress at the East African Court of Justice so that the governments can be compelled to employ tough measures to tame the setbacks,” Polycarp Igathe, chairman of the Kenya Association of Manufacturers, warned in an interview published on Kenya’s Standard Digital website.

The scorecard’s findings come amid some good news, however, as the private sector ramps up the pressure on governments.

Kenya, for example, says it will have a new online customs clearance system in 18 months as part of reforms aimed at improving efficiency in cargo handling at the port of Mombasa, which also serves landlocked Burundi, Rwanda and Uganda. The old Simba system was condemned for its frequent breakdowns.

EAC governments also launched the “single custom territory,” with a destination model for clearing goods that assesses and collects revenue at the first point of entry.

And in another positive move, Uganda, Kenya and Rwanda in February launched a ‘single destination’ tourist visa in Kampala, Uganda’s capital. The East African Tourism visa costs US$100 and is valid for 90 days. It allows visitors to travel around the three countries without seeking any other travel document and can be obtained in any of the countries, or at their embassies, high commissions and consular offices.

Meanwhile, local manufacturers are aggressively promoting their goods throughout the region.

Under TradeMark East Africa’s MarketLinked program, 11 Rwandese manufacturers traveled to Kampala in March to showcase such items as processed food and beverages, organic pyrethrum-based insecticides and insect repellents, LED energy saving lights, furniture, granite tiles and surfaces, high-quality chalk for schools, liquid soaps, paper goods, and organic tea.

Ugandan companies are scheduled to go to Burundi in May in a similar MarketLinked trade mission.

Trademark East Africa is a nonprofit that supports EAC integration through programs in collaboration with the EAC Secretariat, national governments and the private sector. Based in Nairobi, it is funded by the governments of Belgium, Denmark, Netherlands, Sweden and Britain.

Below are some of the scorecard’s findings.

Capital movement

The EAC Common Market Protocol identifies 20 operations that should be free from legal and regulatory encumbrances. These cover securities (quoted and unquoted securities, some collective investment schemes, money market instruments, and derivatives); credit (external borrowing and lending by residents); direct investment (direct international acquisitions, greenfield investments, establishment of branches of enterprises, re-investment of profits in enterprises, outward direct investment, and repatriation of profits from asset sales); and personal capital.

Kenya, with 17 of 20 unrestricted operations, makes it easiest for capital to move across the EAC, while Burundi and Tanzania, each with only four of the 20, make it hardest. Rwanda and Uganda each have 15 of the 20 open.

The Bank of Tanzania, for example, restricts outward direct and portfolio investments, foreign lending favoring nonresidents, acquisition of foreign real estate, operation of offshore foreign currency accounts by residents, and participation by non-residents in domestic money markets and capital markets.

Moreover, any Tanzania resident can acquire, sell or transfer to any person within or outside the country any security or coupon on which capital moneys, dividends, or interest are paid in foreign currency, but only if the security or coupon was bought solely with externally acquired funds and the Bank of Tanzania is notified.

Under foreign exchange rules in Burundi, residents must obtain Central Bank approval to buy foreign shares or securities, or to lend or invest overseas.

Of the 20 capital operations, only two – external borrowing by residents and repatriation of proceeds from sale of assets – are free in all five EAC states.

Services

A review of more than 500 key sectoral laws and regulations identified at least 63 measures that are inconsistent with commitments to liberalize services trade in the region. The review focused on professional services (legal, accounting, architectural, and engineering), road transport, distribution (retail and wholesale), and telecommunications legislation.

Professional services account for 73 percent of the 63 identified measures, led by engineering with 16 measures; accounting, 14; and legal services, 10. The other measures involve road transport, 15, and wholesale distribution, 2.

Telecommunications and retail were the only sectors with no identified measures inconsistent to the protocol. However, restrictions on services trade within the EAC still exist in these sectors, and they are scheduled for elimination before 2015.

Restrictive measures are most common in Tanzania, with 17, and Kenya, with 16, followed by Rwanda, 11; Uganda, 10; and Burundi, 9. Burundi’s strong performance on the scorecard is partly due to the fact that some of its sectors are not yet regulated through sectoral legislation.

Goods

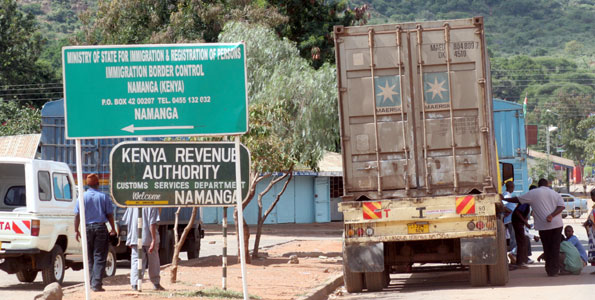

Fifty-one non-tariff barriers were identified, most often are linked to rules of origin, sanitary and phytosanitary measures, charges of equivalent effect, and technical barriers to trade. Tanzania accounted for 18 of the 51, Kenya for 16, Uganda for nine, Rwanda for five, and Burundi for three.

While all five countries formally comply with their commitments to harmonize and mutually recognize sanitary and phytosanitary standards, and technical standards, effective implementation of those standards remains an important problem, affecting all areas and especially food products.

Similarly, all five countries have formally eliminated tariffs on intra-regional trade, but measures with “equivalent effect” remain. For example, but EAC certificates of origin are often not recognized at borders.