Bullish On The KINGs

In an analysis prepared for Investing in Africa, Belgrad Kenne, founder and director of Phase One Associates, a Nairobi, Kenya, research boutique specializing in the frontier equity markets of Africa, explains why he is bullish on what he calls the “KINGs” (Kenya, Ivory Coast, Nigeria, and Ghana) as investment “sweet spots.” The KINGs posted a 39 percent, US$-adjusted, price return in 2013, beating all MSCI leading indices and the S&P 500.

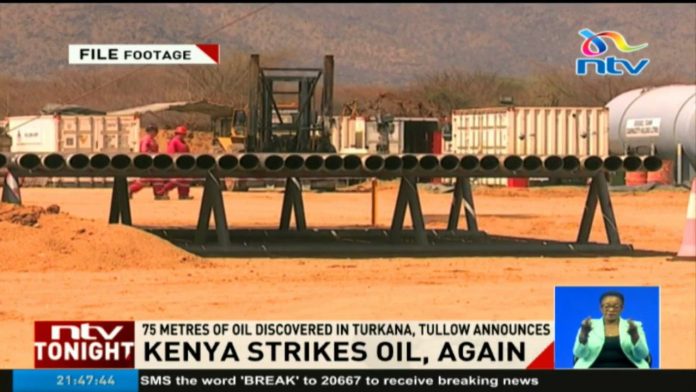

In summary, Kenne says Kenya’s successful elections in 2013 paved the way to an enabling socio-political environment that supports a dynamic economy boosted by oil discoveries. In Cote d’Ivoire, the hub and growth engine of the West African Economic and Monetary Union, robust economic activity is being driven by agriculture, consumer-related sectors and public spending on infrastructure. From 2012 to date, the BRVM has gained over 66 percent, 2 percent of that at the beginning of 2014, and government gross debt has gone from nearly 95 percent in 2011 to an estimated 39 percent this year.

Nigeria soon will become the second biggest weight in the MSCI Frontier Market index behind Kuwait, positioning the country for Emerging Market status in the medium term. That move will increase visibility and liquidity as more capital flows into the country. Moreover, ongoing reforms in the power sector, along with infrastructure improvement, will accelerate growth and open new opportunities for businesses and investors. Cross-border expansion into ECOWAS, the regional common market, will be a boon to many businesses.

Ghana, known for its democratic institutions and favorable business environment, remains an attractive destination despite short-term macro economic concerns over widening deficits and double-digit inflation.

Economic Transformation

The inaugural Africa Transformation Report ranks Mauritius as the most economically transformed country out of 21 sub-Saharan African countries measured in its African Transformation Index. South Africa ranks second, followed by Côte d’Ivoire. Nigeria, which is poised to take over South Africa as the continent’s largest economy, Burundi, and Burkina Faso rank at the bottom of the index. The index takes account of a country’s economic diversification, export competitiveness, productivity, state of technology upgrading, and human well being. Compiled over a three-year period by Ghana’s African Centre for Economic Transformation in partnership with South Africa’s Mapungubwe Institute for Strategic Reflection, the Africa Transformation Report cites key transformation drivers as fostering partnerships between governments and the private sector to facilitate entrepreneurship; investment and technology upgrading; promoting exports, particularly outside of natural resources; building technical knowledge and skills; and moving forward with regional integration. The report highlights four transformation pathways: labor-intensive manufacturing; kickstarting agroprocessing value chains; improving the management of oil, gas and minerals; and boosting tourism.

Millionaires Nigeria

Nigerian millionaires will increase in number by almost 47 percent over the next four years as higher house and stock prices in the West African nation complement a booming economy, according to South Africa-based New World Wealth. The number of people in Africa’s top oil producer with investable assets of at least $1 million will jump to 23,000 by 2017, after increasing by 44 percent over the past six years to 15,700 in 2013, the report said. About 26 percent of their $82 billion of wealth was held offshore last year, with the bulk of private-banking funds deposited in Britain, Switzerland and the Channel Islands, the report said. Nigeria is home to five billionaires, according to the report, including Africa’s richest man Aliko Dangote, whose businesses range from cement to sugar. Dangote, CEO of Dangote Group, has a net worth of $25.2 billion, ranking him 24th on the Bloomberg Billionaires Index. Nigeria also has the third-highest number of millionaires on the continent after South Africa and Egypt, according to New World Wealth. Lagos, the commercial capital, was home to 9,500 millionaires, or 61 percent of Nigeria’s total. Next came Port Harcourt, the oil industry hub, with 1,300, and the capital Abuja with 600. The oil and gas industry was the source of 24 percent of this wealth.

Millionaires Kenya

Kenya has the fourth highest number of high net worth individuals (HNWIs) in Africa after South Africa, Egypt and Nigeria, according to South Africa-based New World Wealth. In 2013, there were approximately 8,300 millionaires in Kenya, with a combined wealth of US$31 billion, accounting for roughly 62 percent of Kenya’s total individual wealth of $50 billion. Kenyan millionaires outperformed the worldwide millionaire average during the review period, with Kenyan numbers increasing by 24 percent, while worldwide volumes declined by 0.3 percent. Kenya’s millionaire growth was positively influenced by rising commodity prices and business growth, particularly in the construction and real estate, telecoms, banking and transport and logistics sectors. The rise in U.S.-dollar-based HNWI wealth was notable, as it occurred despite a significant depreciation of the Kenyan shilling against the U.S. dollar during the review period. Over the four-year forecast period, the number of Kenya’s millionaires is forecast to grow by 28 percent, reaching 10,700 by 2017. HNWI wealth will again see a slightly larger percentage increase, growing by 30 percent to reach $41 billion in 2017.

Mobile Phones

IHS Towers, based in Lagos, Nigeria, said it raised $420 million in equity and $70 million in debt “to finance acquisitions, help its customers expand coverage and capacity by building new towers and continue investing in alternative energy.” IHS, Africa’s largest mobile infrastructure company, sold the equity to Goldman Sachs, the IFC Global Infrastructure Fund, and African Infrastructure Investment Managers, and to existing shareholders. Goldman Sachs’s investment marks the U.S. investment bank’s entry into the continent’s mobile phone industry. IHS also secured $70 million in senior debt from Standard Chartered Bank and said it will use this money to expand its operations in Zambia. IHS owns and manages about 10,500 transmitter towers in Nigeria, Cameroon and Côte d’Ivoire, and has built an additional 3,500 for telecommunications operators. In December, it agreed to buy 1,200 tower sites in Rwanda and Zambia from South Africa’s MTN, with MTN becoming the anchor tenant on these towers for an initial 10 years.

Air Cargo

Global air cargo surged 4.5 percent in January from a year earlier, driven by solid growth across all regions, but rising protectionism could clip growth, the International Air Transport Association (IATA) said. The increase marked a significant acceleration on the 2.2 percent year-on-year growth in December, and was well above the 1.4 percent rise in 2013 traffic, the industry body noted. IATA said African carriers kept pace with the global market, with traffic rising 4.1 percent in January, but signs of growth slowing in South Africa and other major regional economies suggest air freight demand could be sluggish over the next few months. It said African airlines saw their freight volumes rise 1.7 percent in December 2013 and grow 1.0 percent for the year overall. After a strong start to 2013, volumes suffered from a mid-year lull, which continued into the second half of the year, with weakness in major economies like South Africa, as well as a slowdown in regional trade dampening demand, IATA said.

Ocean Freight

Cosco Shipping, the world’s largest fleet of specialized carriers and multipurpose vessels owned by China Ocean Shipping (Group) Co., expanded its African footprint to more that 33 countries this year, with tons of cement shipped to Lagos, Nigeria; hydropower equipment delivered to the port of Luanda in Angola; and construction machinery bound for Addis Ababa through the port of Djibouti, according to a report in China Daily. Han Guomin, Cosco Shipping’s general manager, said the continent’s hunger for trade opportunities, infrastructure improvement, appliances and electronics has pushed eager manufacturers from the United States, Europe and China to load their products onto vessels for Africa. Cosco Shipping’s entry into the African market began in the 1960s, when it transported engineering equipment, materials and workers to build the Tanzania-Zambia Railway. ![]() With more than 100 ships, including asphalt tankers, lumber carriers and heavy lift vessels in operation, Cosco Shipping has been helping Chinese companies to do business in Africa for more than four decades. The company expects its 2013 profit to reach 31 million yuan (US$5 million). So far, it has deployed 25 vessels between China and Africa, with six ships operated on this route each month. It also serves clients in South Korea and Japan that ship goods to the African market.

With more than 100 ships, including asphalt tankers, lumber carriers and heavy lift vessels in operation, Cosco Shipping has been helping Chinese companies to do business in Africa for more than four decades. The company expects its 2013 profit to reach 31 million yuan (US$5 million). So far, it has deployed 25 vessels between China and Africa, with six ships operated on this route each month. It also serves clients in South Korea and Japan that ship goods to the African market.